As it does every year, VRPorn.com looks back at the preferences, habits and surprising trends of millions of VR viewers worldwide. This edition of the annual report reveals how quickly the world of adult VR is evolving - and how our viewing habits are moving with it. Read the full post here.

8K conquers the top

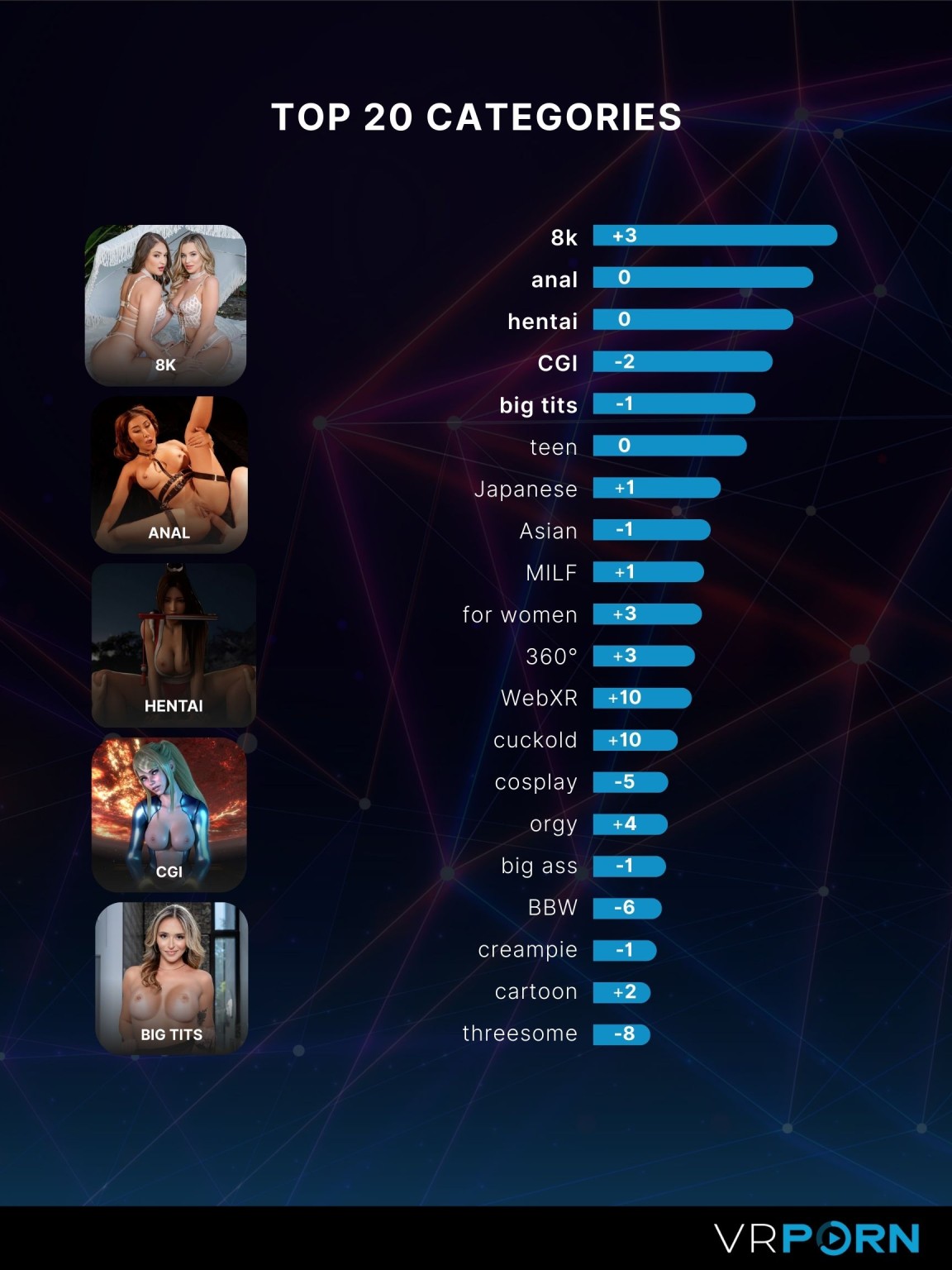

If you thought 8K VR videos were a niche, think again. In 2024, this category shot up three spots and nestled in first place as the most popular genre worldwide. In doing so, it even displaced hentai, which dropped one spot to number three. Anal remained firmly at number two, the same as last year.

Also notable: WebXR (VR via browser) and Cuckold content saw a huge jump of +10 spots. Cosplay and Threesome, on the other hand, lost considerable ground, falling -5 and -8 spots, respectively. Viewers apparently want fewer costume parties and more resolution and realism.

Blake Blossom at the top - and women are increasingly watching too

The star of the year? Blake Blossom, topped the list among both male and female viewers. Other emerging favorites include Coco Lovelock (+30 spots!) and Josephine Jackson (+22). Among female viewers, Melody Marks was number one - and remarkably many women chose performers like Little Caprice, Agatha Vega and Molly Little this year.

Another notable trend: the number of female visitors increased again. Especially from Italy, Canada and Romania, more women came to watch, while countries like France and Spain showed a decline. The days when VR porn was only a male affair seem to be increasingly behind us.

Late at night is prime time

The most popular time to watch VR porn? 8 p.m.. But watch out: the biggest increase was precisely in the time slot between 10 p.m. and 11 p.m., with +0.5% growth. That suggests that more people are delaying their session until late at night - perhaps for extra privacy, or simply because it's a perfect time to just dream away in immersive 8K.

Morning viewing is surprisingly steady, by the way, with a slight peak at 6:00 a.m. The low point in terms of viewing time? Around 7:00 a.m., when reality probably calls again.

Netherlands on the move: 8K rises, WebXR breaks through

We see the same global trend in the Netherlands: 8K climbs to spot 2, WebXR makes its debut in the Top 10, and there is growing interest in the For Women and 360° categories. Blake Blossom is again the absolute favorite here, with strong newcomers such as Melanie Marie, Josephine Jackson and Kayley Gunner on the rise.

Yet we also see a shift in viewing time: the Dutch spent less time on average than last year, dropping three spots in the global ranking in terms of viewing time per country. Perhaps we have become more critical - or just more selective in our choices.

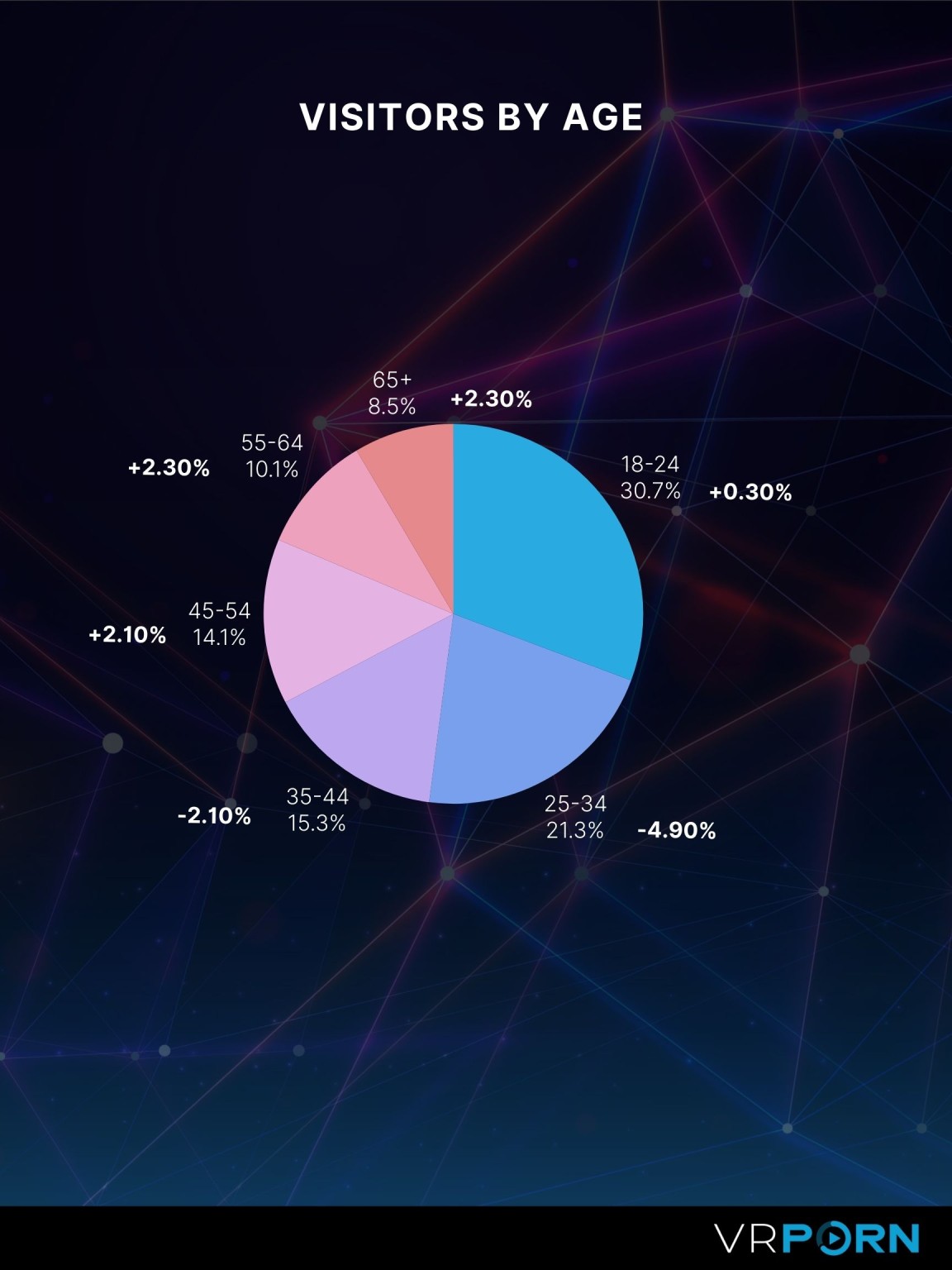

Older viewers are advancing

The biggest growth this year was not in Gen Z, but rather in viewers of 55 years and older. Both the 55-64 and 65+ groups saw an increase of +2.3%, while the 25-34 age group actually showed a solid dip (-4.9%). The conclusion? VR porn has long since ceased to be the domain of only young tech enthusiasts.

Smartphones are gaining ground

Although VR glasses are the main focus, surprisingly many people also watch via their smartphones. Mobile usage increased by +1.5%, while desktop and tablets actually decreased. The message is clear: convenience and accessibility are key - and technology like WebXR makes it possible to dive into VR right from your browser, without the hassle of apps or installations.

Countries that stand out - and countries that cave in

On a global scale, we saw interesting shifts in viewing time by country. Monaco climbed up six spots and now leads the list of countries that view VR content the longest. Also Japan and Iceland are doing remarkably well. In contrast, we saw the U.S. and Canada on the contrary, a drop of seven spots. The Netherlands, France and the UK also lost ground, suggesting that users there may be watching more efficiently but more briefly - or simply be more critical in their selection

What does this say about the future of VR porn?

The numbers leave little to the imagination: image quality, accessibility and female participation determine the direction of the industry. Studios investing in 8K productions and content for wider audiences, such as "For Women" and local niches, seem to be reaping the rewards.